CONVENTIONAL PLAN

Cashback

Saving the smart way

Cashback has never been so gratifying

AfriLife Cashback is a money-back policy. It holds the advantage of being a saving mechanism doubled by a comprehensive life insurance cover.

What's more, it offers at 5-year intervals, pre-defined cash flows enabling you to plan your projects ahead and enjoy the comfort of ready money in required time.

What are your Benefits?

Endowment

Cover yourself and save at the same time

Designed to give you a highly reliable cover while allowing you to save at the same time, our endowment policy also provides financial cover for your family with a bonus at maturity. If life separates you from your loved ones during policy period, your nominee(s) gets the full amount without any stress.

Product Features

Afri Life Cashback

| Type of policy | With profits |

|---|---|

| Can be effected on | A single life or on joint life |

| Frequency of instalments | Every 5 years |

| Available terms | 20 years & 25 years (Must mature on the 70th birthday of the older life) |

| Eligible age at entry | Min. 13 next birthday - max. 50 next birthday |

| Frequency of premiums | Monthly |

| Minimum sum assured | Rs 150,000 |

| Maturity benefits | Balance of the basic sum assured (i.e basic sum assured LESS instalments already paid) The last instalment plus bonuses are payable. |

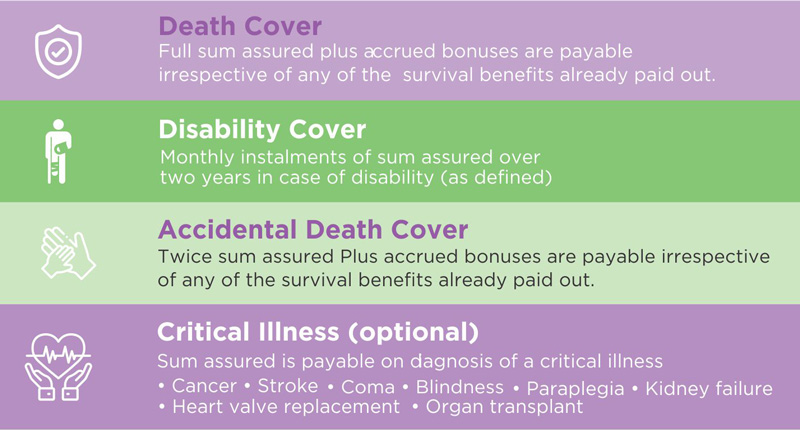

| Death benefits | Basic Sum Assured + accrued bonuses payable |

| Disability benefit (optional) | Monthly instalment of sum assured over two years in case of disability |

| Accidental benefits (optional) | Twice basic sum assured + accrued bonuses |

| Additional death benefit (optional) | Additional basic sum assured |

| Critical illness benefits (optional) | Sum assured is payable on diagnosis of a critical illness (As defined in the policy documents) |

| Remarks | Surrender value as per policy conditions |

Afri Life Endowment Plan

| Type of policy | With profits |

|---|---|

| Can be effected on | A single life or on joint life |

| Available terms | Min 10 - 40 years (must mature on the 65th birthday of the older life) |

| Min. - Max. Age at entry | 13 next birthday - 50 next birthday) |

| Frequency of premiums | Monthly |

| Minimum sum assured | Rs 200,000 |

| Maturity benefits | Basic sum assured PLUS accrued bonuses |

| Death benefits | Basic sum assured PLUS accrued bonuses |

| Disability benefit (optional) | Monthly pension over two years for total of basic sum assured |

| Accidental benefits (optional) | Twice basic sum assured |

| Additional death benefits (optional) | Additional basic sum assured |

| Critical illness benefits (optional) | Sum assured is payable on diagnosis of a critical illness (as defined) |

| Assignment | The policy may be used as security for any loan that the policyholder may be taking from another financial institution |

| Surrender value | No surrender value is payable if policy is cancelled during the first 3 years |